Receipts/Taxes

Start saving every single operational expense receipt so that you can claim your self-employed/business expense deductions on your federal taxes (U.S. Residence) when it’s time to file. Be sure to do your own research so you know what tax forms you need and what deductions you qualify for. Visit the IRS website to start your research.

Start saving every single operational expense receipt so that you can claim your self-employed/business expense deductions on your federal taxes (U.S. Residence) when it’s time to file. Be sure to do your own research so you know what tax forms you need and what deductions you qualify for. Visit the IRS website to start your research.

If crunching numbers and researching deductions gives you a headache, you can always retain the services of your favorite CPA (Certified personal accountant) to handle your taxes for you.

And yes, you do have to file/pay taxes, it’s the law.

![]()

![]()

Storing Your Receipts

You’re going to want to keep your receipts dry so none of the ink smears and out of direct light so the ink doesn’t fade. Below are a few options that might work for you.

- A sealable container that doesn’t let any light in.

- A filing cabinet and file folders.

- A briefcase or sealable bag.

![]()

Federal Income Tax Law

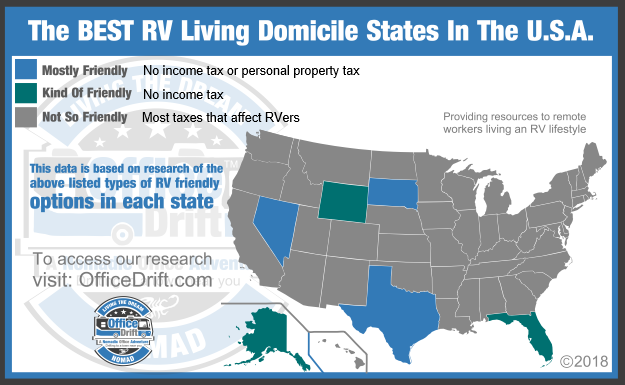

Often, a major determinant of an individual’s status as a resident for income tax purposes is whether he or she is domiciled or maintains an abode in the state and are “present” in the state for 183 days or more (one-half of the tax year). Minnesota’s current budget bill proposes lowering the residency threshold from 183 days to 60 days for individuals who maintain a residence in Minnesota but live part of the year elsewhere. California and New York are particularly aggressive in this respect. There and elsewhere, taxpayers have the burden of proving through documentary evidence which states they spend time in during the year and how long they remain in these states. – Source

According to the federal government, you need to split up your taxes for each state you reside in for longer than 60 to 183 days (Depending on the state). This also depends on the type of business, sales, work, etc. you did there (That’s applicable to Federal and State taxes). Be sure to check with the IRS to make sure you are in compliance.

Thankfully, Texas doesn’t have state income tax or personal property tax. Making it a great choice for domicile/residence (For us anyways).

We have our primary bank and business filings in our domicile state/county (Texas – Harris County), Since our business is online, we can work remotely, through our online business and are still operating out of the state of Texas (Where the business is filed) for tax purposes,

![]()

Tip: Make sure that you have a designated area in your rig just for business-related documents. Staying organized is very important.

![]()

Be sure to review all our resources. Don’t skip anything we outlined there. We know it’s a lot of reading, but you’ll be thankful you read it all later.